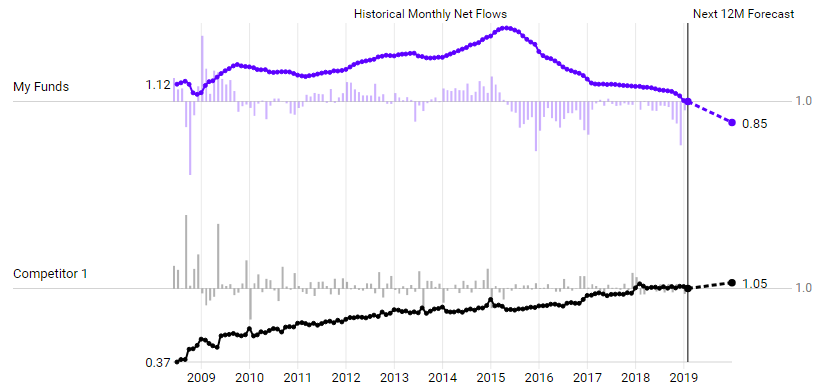

If It's Not Forward-Looking, It's Not Actionable

We forecast organic growth rates at the shareclass level

Backward-looking report cards of fund flows aren't going to cut it in the intensely competitive environment we're in today. You need forward-looking analytics informing your decisions to effectively meet investor needs before the competition siezes the opportunity.

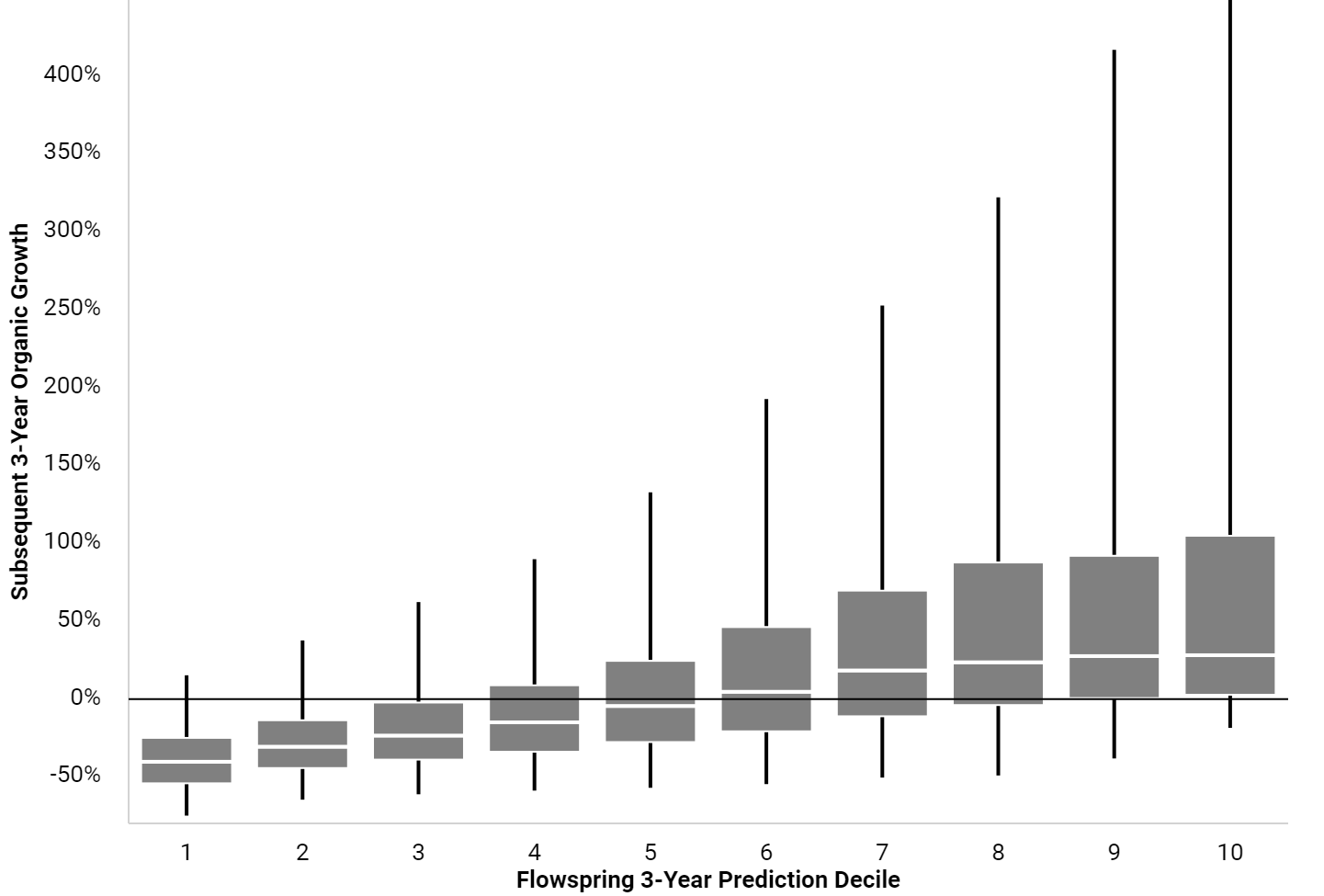

Rigorous quantitative methodologies

More than a decade of research and quantitative expertise is embedded in our quantitative forecasting models. We use rigorous non-linear algorithms well-suited for modeling nuanced mutual fund and ETF data.

Fully validated predictive performance

Our forecasting models are battle tested. We continually assess their predictive performance and iteratively improve them to capture emerging investor preferences. Consequently, asset managers trust our forecasts to be accurate and actionable.