Looking Back and Moving Forward

A Data-Driven Approach to 2023

The asset management industry was faced with a range of challenges and opportunities in 2022. The Federal Reserve’s rate raising campaign collided with headwinds faced by a number of companies who were not able to maintain the pace of their post-pandemic rebounds, leading to significant market losses and historic fund withdrawals. Nevertheless, the industry demonstrated its resilience and ability to adapt through its continued evolution and innovation.

Liquid Alts - Will the Cream Rise to the Top?

An Analysis of the Liquid Alternatives Market

In a complex and competitive market, alternative investments continue to gain traction as a tool for hedging against the traditional 60/40 portfolio. Through a wide range of investment types, alternatives claim to provide a hedge when traditional approaches fail to produce yield. Are these investments actually increasing in assets under management? How can asset managers stay informed about benchmarks and predicted flows in this space? Flowspring, our predictive analytics tool for asset flows, can serve as an integral part in answering these questions, leading to faster and more accurate decision-making.

Investor Preferences Are the Signal in Fund Flow Noise

Distilling investor preferences from fund flows lead to better outcomes for asset managers

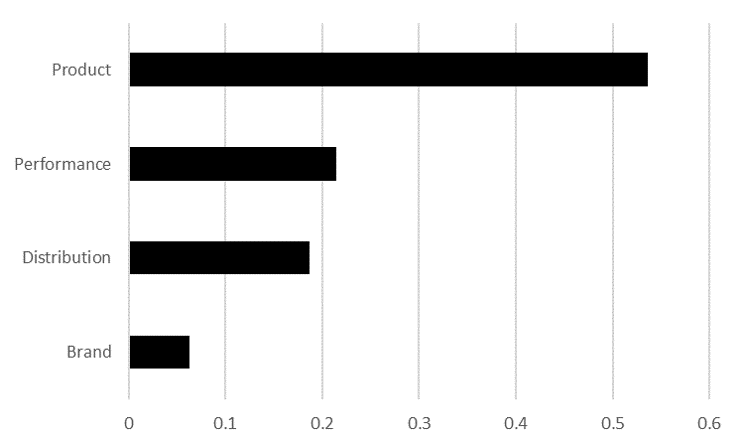

There may be no industry so inundated with data as asset management, yet asset managers still underwhelm with their ability to create commercially successful products, suggesting that asset managers struggle to draw insight from the data available to them. Investor preferences may be the most important measure for asset managers given their impact on every facet of the business. In this paper we investigate how asset managers measure investor preferences and find that a more rigorous statistical approach could yield significant financial benefits for asset managers.

COVID-19 Asset Management Weekly

A weekly report on the impact of COVID-19 on the asset management industry.

Our weekly summary of the evolving COVID-19 pandemic. This report is meant to provide a repository of relevant data to evaluate ongoing health, market, and asset flow impacts which may aid your decision making.

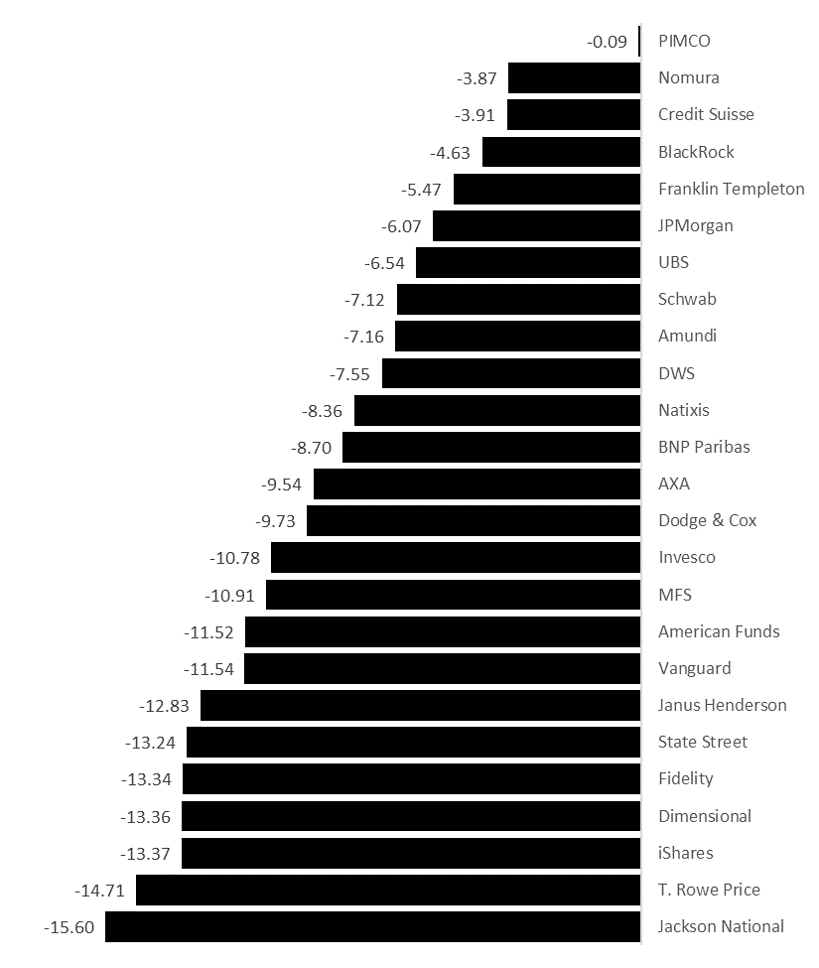

On Swimming Naked and Tides

Vulnerable asset managers are in for a world of pain when markets turn from bull to bear

As the current bull market enters its 11th year, we raise the question: which asset managers are positioned for the inevitable bear market? Warren Buffet once noted, “You only find out who’s swimming naked when the tide goes out.” With due respect to Mr. Buffet, put on your goggles, because we’re about to dive below the surface and find out exactly who’s swimming naked before the tide goes out. We study the largest 25 asset managers and assess their fee sensitivity to market downturns in various asset classes.

Asset Management Quanta

April 2019

Flowspring's Asset Management Quanta is a monthly compilation of the most important trends and

statistics in the asset management industry. This particular report was compiled as of April 2019 to give an accurate picture of the global open-end and exchange-traded fund landscape. It contains information relating to the distribution of assets, changes in assets, trends in fees and fund launches, and emerging investor preferences. We present this report without commentary so as to provide updated data in a timely manner, and to allow the data to speak for itself.

The Game Theory of Fund Price Wars

Why asset managers will soon pay you to invest in their funds

The fund industry continues to raise the competitive stakes by lowering their fees, particularly on passive and exchange-traded products. Naturally every stakeholder questions how far this trend can go, and who will win this war of attrition. We use a simple dollar auction game to demonstrate that fees can indeed go lower

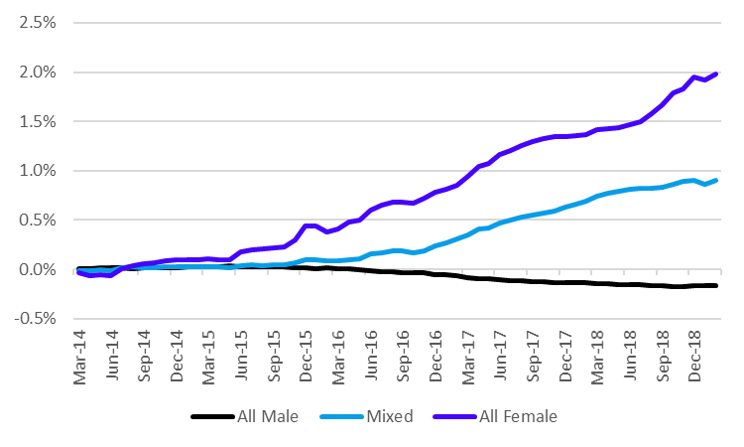

Women in Asset Management

Women are under-represented in portfolio manager roles to the detriment of asset managers

Like many areas of finance and STEM industries, women are severely under-represented among the ranks of portfolio managers in the asset management industry. According to the Bureau of Labor Statistics, industries with comparable levels of female employment are iron and steel mill manufacturing, mineral mining, cement & concrete manufacturing, and truck transportation. Given the magnitude of this underrepresentation, we studied the financial impact of portfolio manager gender on asset flows to determine whether asset managers could financially benefit from hiring additional women.

The Social Responsibility Boom

Socially Responsible Funds Fuel Growth, but Competition for Assets is Heating Up

It’s no secret that socially responsible investing is on the rise, but in the past several years, it’s risen from novelty fund characteristic to ubiquitous deployment across the strategy spectrum. While some investors question the validity of mixing morality with investment outcomes, it’s clear that the boom in socially responsible investing is full-steam-ahead. We analyze a global universe of open-end fund and ETF products to determine the extent of investors preference for socially responsible funds, asset managers’ pricing of such funds, and the performance trade-offs (or lack thereof) of investing in such funds.

The Price is Wrong

The Massive Impact of (Mis)pricing Investment Products

How much to charge for an investment product is a decision asset managers wrestle with daily, and the financial implications of that decision are staggering. We analyze a universe of more than 20,000 global shareclasses of open-end funds and ETFs through the Flowspring Global Pricing Model and Flowspring Global Flow Model to make sense of the rapidly changing pricing landscape for investment products.

Rationalize This!

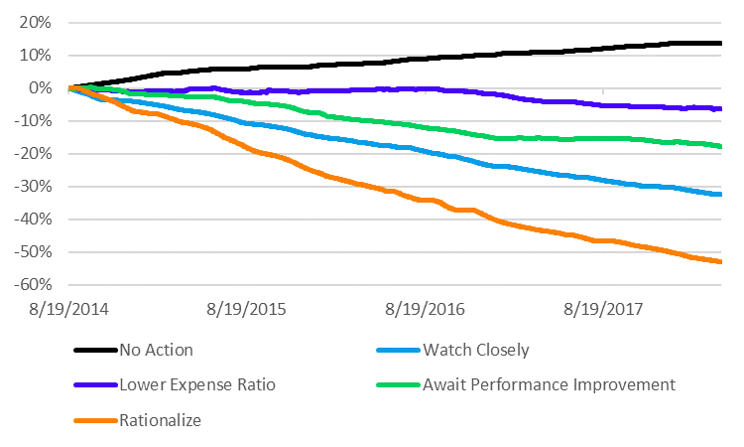

Introducing the Flowspring Rationalization Recommendation: A Starting Point for Analyzing Struggling Funds

The number of mutual funds and ETFs has grown significantly over the past several years. Many of these new launches struggle to gain assets in the increasingly competitive asset management environment. Consequently, rationalization discipline is key to maintaining a strong product line-up that can grow, remain resilient to market conditions, and accrete value to a firm’s brand. We’ve developed the Flowspring Rationalization Recommendation to help asset managers with a starting point for analyzing struggling funds.

Distribution Domination

Quantifying the Skill and Value of Fund Distributors

An asset manager could have the most attractive product line-up among all its competitors, but without distribution, they will flounder. The necessity of distribution is only growing stronger as the industry becomes more competitive. Using the Flowspring Global Flow model, we quantify the skill of distribution companies to determine the most elite fund distributors thus far in 2018.

Solar-Powered Fund Flows

How the Morningstar Star Ratings Drive Fund Flows

It’s no secret that independent 3rd party fund ratings influence the way investors think about mutual funds and ETFs. The Morningstar Star Rating, in particular, has shown to be predictive of future fund flows. We examine this relationship in more depth and find some interesting nuance to the link between the Morningstar Star Rating and fund flows.

Everything You Think You Know About Fund Flows is Wrong

Backward-looking Category-based Analysis Will Lead You Astray

The study of fund flows informs nearly all product decisions at asset management firms. The prevailing method of understanding flows is to aggregate historical flows by category. We show that this method is deeply flawed because it does not properly account for other flow drivers that are highly correlated with fund categories. Moreover, it does not properly relate past flows to future flows, potentially leading to disastrous conclusions.

Elasticity Rising

Finding Pockets of Price-Insensitivity in an Increasingly Price-Sensitive World

The ability to price funds appropriately is paramount to the continued success of asset management firms. That task has become more difficult recently as major shifts are occurring in the price elasticity of demand for managed investment products. We examined trends in price elasticity across our global database of funds using the Flowspring Global Flow model.

Bucking the Trend

How the Latest Crop of Investment Products are Reshaping the Fund Landscape

The fund landscape has undergone incredible transformation in the last 10 years, largely due to the divergence of newly launched funds. Over the last 12 months, asset managers launched 3,087 new open end fund and ETF shareclasses. We analyze the characteristics of new funds through time and identify some key trends.