Correctly assessing investor preferences is hard

Not every asset manager has a team of Ph.D. statisticians separating signal from noise in asset flow data. Unfortunately, simple, seemingly sensible analyses, like summing flows into categories or groupings in order to understand investor preferences, will lead you to staggeringly inaccurate conclusions. Only with a factor model can you properly disentangle all of the investor preferences that are embedded in observable asset flows.

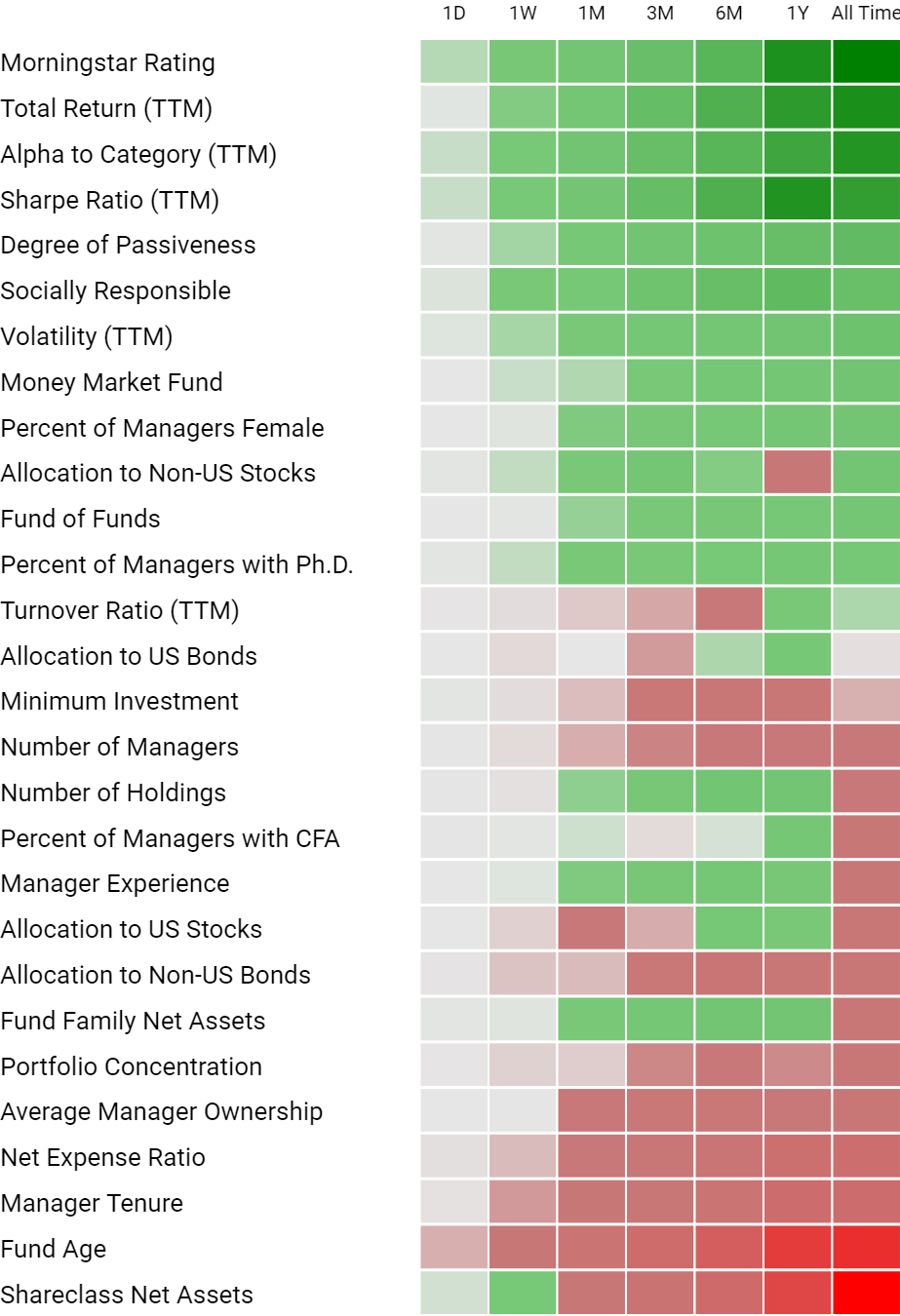

Flowspring does the statistical legwork with a factor model of organic growth

Factor models are routinely used by quantitatively minded investors to perform attribution analysis, dial-in specific risk allocations, and generally predict market movements. Factor models are even more suited to modeling organic growth rates there is no market mechanism which competes away factors that explain organic growth rates.