Distribution Domination

Quantifying the Skill and Value of Fund Distributors

April 2018

Executive Summary

An asset manager could have the most attractive product line-up among all its competitors, but without distribution, they will flounder. The necessity of distribution is only growing stronger as the industry becomes more competitive. Using the Flowspring Global Flow model, we quantify the skill of distribution companies to determine the most elite fund distributors thus far in 2018.

Distribution skill explains 27% of the variation in fund flows across funds in 2018 – nearly three times as much as the fund’s brand, but only half as much as product characteristics.

The best and most poorly distributed funds exhibit persistence, with more than 50% remaining in the top or bottom quintile of distribution contribution after 1 year.

American Funds Distributors Inc. is the most valuable distributor, bringing in $23 bil in new fees for its funds thus far in 2018. Ladenburg Thalmann & Co Inc. is the most skilled distributor – responsible for growing assets by 3% and fees by 3.4% thus far in 2018.

In-house distribution organizations have consistently outperformed third party distribution firms, although the difference between the two is economically insignificant.

Asset Management is Increasingly Competitive

The influx of new funds, increasing pressure on fees from investors, and the threat of regulation has made the asset management industry more competitive. This trend persists, despite the growing pie of assets that have accompanied the bull market of 2009 through 2018.

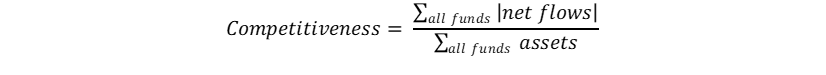

Increasingly, asset managers are fighting to keep their slice of the pie. We can calculate this competitiveness with a simple ratio.

Larger values of this ratio would indicate that a greater portion of assets are moving into and out of individual funds, while conversely, lower values indicate smaller portions of assets are moving into and out of funds. Naturally, the industry is more competitive as the ratio increases.

Figure 1: The competitiveness of the asset management industry through time.

Aside from some occasional spikes, we can see a steady increase in the competitiveness of the industry through time, and we see no reason that the underlying causes of this competitiveness should subside. Net product growth is still positive, expense ratios continue to fall, and if anything the bull market is unsustainable in the long term.

Distribution organizations are on the front-lines of this intensifying competitive war. As demand aggregators and generators, these groups work to win the most business for the funds that they fight for – seeking to make favorable comparisons to competitors, position themselves as thought leaders, and bring the latest product innovations to market.

As competition continues to intensify, we expect distribution to play an increasingly important role in the success of asset management firms.

Distribution is a Multiplier for Asset Managers

There are four key categories of drivers of fund flows:

Product – the defining characteristics of a fund, including fees, legal structure, management team composition, and investment strategy

Performance – the expected investment performance (return, risk, absolute or relative) of a fund, often proxied as its past performance.

Brand – the reputational capital of a firm, that, all else equal, will naturally incline an investor towards investment in a firm’s funds.

Distribution – the ability of an asset management firm to convince investors, through various channels, that their products are worthy of investment.

Distribution skill, in particular, is difficult to quantify by traditional means. However, by using a factor model of flows, like the Flowspring Global Flow model, we can attribute the net flows of a fund to distribution, while simultaneously controlling for the other three categories of flow drivers. We find that, across all funds, product is the most important driver of flows, followed distantly by distribution and performance, with brand being the least influential.

Figure 2: Factor categories’ explanation of the variance in fund flows

More interesting, we find that the relationship of these categories to flows is not additive, but multiplicative. That is, firms with great products, great brands, or great performance also experience abnormally high distribution contributions to growth.

Figure 3: Correlation of distribution contribution with product, performance, and brand contributions to net flows

As a result of this multiplicative relationship, the most well-rounded firms are those with the greatest flow growth.

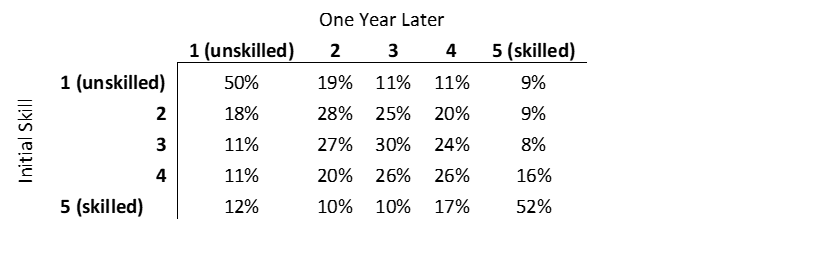

Distribution Skill is Persistent for the Best and Worst

Not all distribution organizations are created equal. In fact, there is large disparity in the distribution of distribution skill. Funds with the most skilled distributors experience upwards of 15 percentage points of growth in excess of that of funds with unskilled distributors.

Further, the skill of distributors on the extremes is persistent. That is, highly skilled distributors tend to remain that way, while unskilled distributors also remain that way.

Figure 4: Transition matrix of distribution skill quintile

We divided our distributor universe into five equal buckets based on distribution skill at each day in our historical database. We then compared how the distribution skill quintile changed one year later. More than 50% of distributors in the most unskilled bucket (1) and the most skilled bucket (5) were in the same bucket one year later. There was significantly more transition in buckets 2, 3, and 4, indicating that only the best and worst are truly different from the pack.

In-House Beats Outsourcing, but Not by Much

Asset managers have a choice when distributing their funds: spin up their own in-house distribution organization or outsource those responsibilities to a third-party. One natural consideration is cost, and the ability to amortize that cost across a large number of funds. For these reasons, it’s much more common for large asset managers to have their own distribution organizations, while smaller firms choose to outsource.

Figure 5: Cumulative excess growth of funds with in-house distribution versus funds with outsourced distribution

Unsurprisingly, firms that run their own distribution organizations outperform those that outsource. In-house distributors are solely focused on the funds of their own firm, and are better able to coordinate with the marketing, product, investment, and compliance organizations. However, while the benefits of in-house distribution are consistent through time, they are economically insignificant. The benefit to in-house over third party distributors is less than 0.1 percentage points of flow growth per year.

The Best Distributors

There are two means for evaluating distributors – the skill they employ in bringing new funds in the door, and the magnitude of the value they create by doing so. Skill is independent of fund size and reflects the incremental percentage of flow-based growth attributable to the distributor. These top 10 distributors have significantly impacted the growth of their funds in the first several months of 2018.

| Distribution Skill | |

|---|---|

| Ladenburg Thalmann & Co Inc | 3.0% |

| T. Rowe Price Investment Services, Inc. | 2.8% |

| Voya Investments Distributor, LLC | 2.6% |

| Ashmore Investment Management (US) Cor | 2.4% |

| Teachers Personal Investor Services Inc | 2.4% |

| Prudential Investment Mgt. Services LLC | 2.4% |

| Charles Schwab & Co Inc | 2.3% |

| American Funds Distributors Inc | 2.2% |

| DFA Securities LLC | 2.0% |

| Morgan Stanley Distribution, Inc | 1.9% |

Figure 6: Top 10 distribution organizations ranked by percentage contribution to flow growth in 2018.

Distributor value, on the other hand, reflects the dollar amount of fees attributable to the additional AUM brought in by distributors. Naturally, this measure is impacted by the AUM of the funds being distributed as well as their net expense ratios.

| Distribution Value | |

|---|---|

| American Funds Distributors Inc | 23,390,120,348 |

| T. Rowe Price Investment Services, Inc. | 15,458,772,490 |

| Vanguard Marketing Corporation | 7,831,991,415 |

| Fidelity Distributors Corporation | 7,438,464,465 |

| BlackRock Investments, LLC | 3,559,702,870 |

| DFA Securities LLC | 3,019,205,452 |

| JPMorgan Distribution Services Inc | 2,266,102,205 |

| PIMCO Investments LLC | 1,956,134,603 |

| Teachers Personal Investor Services Inc | 1,397,144,222 |

| Foreside Funds Distributors LLC | 1,153,431,774 |

Figure 7: Top 10 distribution organizations ranked by total incremental fees generated in 2018

While Vanguard Marketing Corporation has brought in the most AUM for its firm in the first months of 2018, it takes the third spot on the distribution value list because it’s fees are much lower than its counterparts, thereby contributing less value to Vanguard funds.

Conclusion

It’s readily apparent that the asset management industry is becoming more competitive, placing pressure on firms to create innovative products, lower prices, and achieve top level performance. Distribution plays a crucial role as well, as skill in distribution multiplies the impact of these other categories.

Today, only a small number of distribution organizations persist in their skill – the best and the worst. Middling firms exhibit no lasting relationship to flows, indicating that the truly skilled are using practices that consistently allow them to outperform their peers in the marketplace (irrespective of the products, brands or investment performance of the products they’re distributing).

As competition increases further, distributors will continue to need tools to increase their size of the pie – a pie which has grown over the bull market of the last several years, but will inevitably shrink in the next downturn.

References

Davidson, Lee, and Timothy Strauts. What Factors Drive Investment Flows. Morningstar, Inc., 2015.

Gremillion, L. L. (2005). Mutual fund industry handbook: A comprehensive guide for investment professionals. Hoboken, NJ: John Wiley & Sons.

Phillips, B. F., Levi, J. A., & Cloherty, J. T. (2016). Survival of the Fittest: Defining Future Leaders in Asset Management.

Reid, B. K., & Rea, J. D. (2003). Mutual Fund Distribution Channels and Distribution Costs. Investment Company Institute Perspective,9(3). Retrieved from https://www.iciglobal.org/pdf/per09-03.pdf.

Contributors

Warren Miller, CFA

Founder & CEO

warren.miller@flowspring.com

©Flowspring, Inc. All Rights Reserved. The information, data, analyses and opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or accurate. The opinions expressed are as of the date written and are subject to change without notice. Except as otherwise required by law, Flowspring shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information contained herein is the proprietary property of Flowspring and may not be reproduced, in whole or in part, or used in any manner, without the prior written consent of Flowspring.