Women in Asset Management

Women are under-represented in portfolio manager roles to the detriment of asset managers

March 2019

Highlights

Like many areas of finance and STEM industries, women are severely under-represented among the ranks of portfolio managers in the asset management industry. According to the Bureau of Labor Statistics, industries with comparable levels of female employment are iron and steel mill manufacturing, mineral mining, cement & concrete manufacturing, and truck transportation. Given the magnitude of this underrepresentation, we studied the financial impact of portfolio manager gender on asset flows to determine whether asset managers could financially benefit from hiring additional women. Our key findings include:

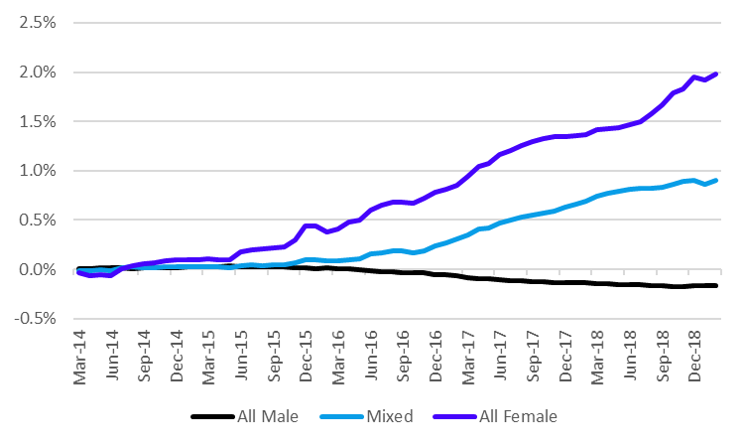

Investors show a steady, albeit economically weak, preference for female-managed funds. Female-only funds grew by 2 percentage points more organically over the last five years than their male-only managed peers.

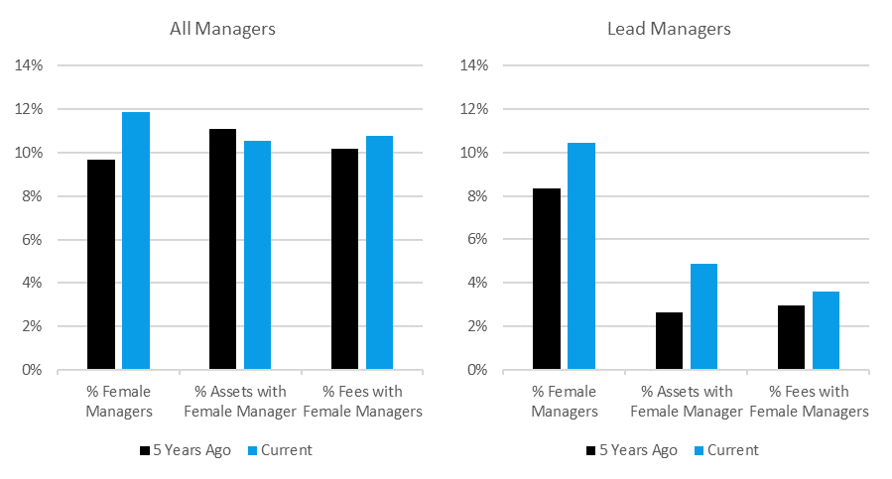

Women have made slight gains in portfolio manager roles, assets managed, and fees earned over the last five years.

Women tend to manage more passive investment products that exhibit lower turnover, larger fund sizes, and lower expense ratios.

Much of the female under-representation in asset management may occur in the early stages of one’s career as only 16% of CFA charterholders are women.

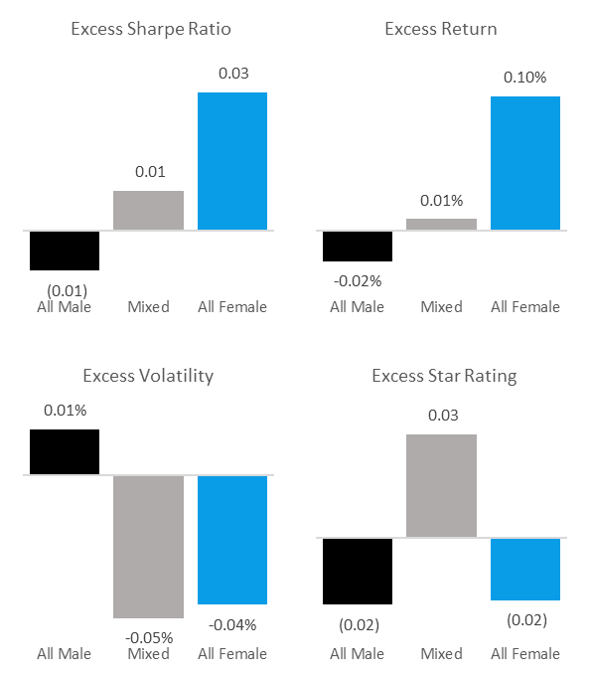

Over the past five years, teams with at least one female portfolio manager have outperformed all-male portfolio management teams on absolute returns, risk-adjusted returns, relative risk-adjusted returns, and risk.

Women are significantly under-represented in portfolio management roles

Women make up roughly half of the global population, but only hold 12% of all portfolio manager roles. There are numerous possible reasons for this discrepancy, including, but not limited to:

Women gravitating towards other careers outside of asset management for various reasons

Conscious or unconscious bias in the hiring process for portfolio managers

Figure 1: Female under-representation in all portfolio management roles (left) and lead portfolio management roles (right)

Some asset managers have taken a stand against female under-representation in the corporate boardrooms of companies they hold in their portfolios – most publicly perhaps by State Street Global Advisors with their Fearless Girl campaign and statue. Yet within their own industry a vast chasm still exists between the number of men and women in portfolio management positions.

While the exact cause of female underrepresentation is difficult to pin down, and outside the scope of this paper, it is worth noting that 16% of CFA charterholders are women. This number supports two conclusions. First, a large portion of the under-representation may be explained upstream, in that earning a CFA is reflective of intent to enter or further a career in the asset management industry. However 16% is also higher than the number of female portfolio managers indicating that there may be at least some bias in the hiring process for portfolio managers.

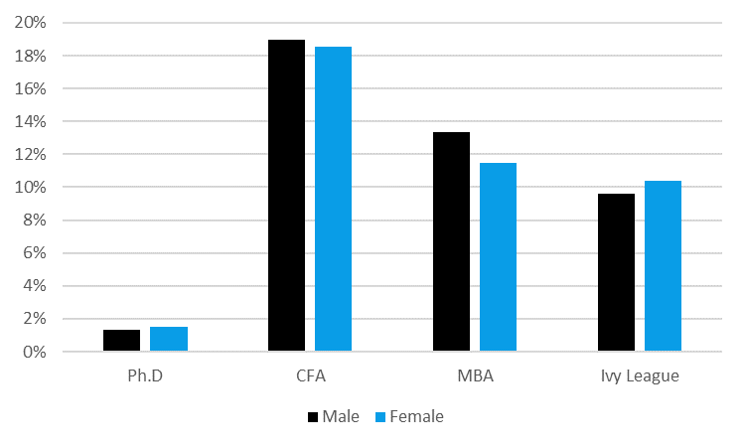

Furthermore, there is no meaningful difference in the credentials of men and women in the asset management industry. Male and female portfolio managers both earn Ph.D.s, CFAs, MBAs, and attend Ivy League schools at roughly similar rates.

Figure 2: Credentials of male and female portfolio managers

One area where we don’t see under-representation is in promotions. Women earned roughly 10% of the promotions to lead portfolio manager roles over the last three years. Since this is roughly proportional to their overall representation among portfolio managers, there seems to be no gating factor here. Although this promotion rate also is not doing anything to reverse the under-representation we see among all portfolio managers.

It is nigh impossible for every group to be perfectly represented in every industry. Under- or over-representation will always exist to some extent, and by itself, is not necessarily nefarious or even an undesirable outcome if it arises out of the rational and unbiased choices of individuals in a free market. However, the discrepancy in female representation in asset management is significant, and we think it’s worth taking a look at whether this is a rational outcome. In the remainder of this paper, we’ll examine the patterns and financial impact of female representation in asset management.

More women manage more passive funds than active funds

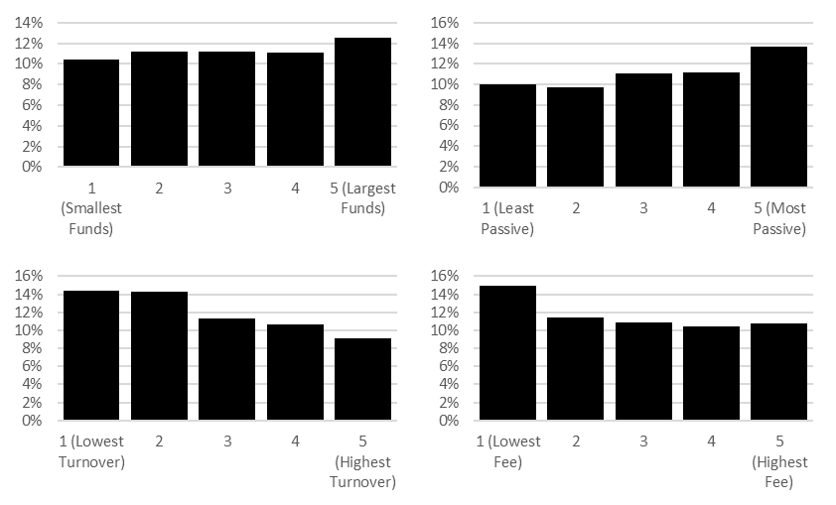

While the overall percentage of female portfolio managers is 12% globally, this number varies significantly by fund category, turnover ratio, fund size, degree of passiveness, and net expense ratio. Variance across each of these dimensions reflect a common theme that women seem to have more portfolio management roles for cheaper, larger, passive products.

Figure 3: Female percentage of portfolio management positions by fund size (top left), degree of passiveness (top right), turnover ratio (bottom left), and net expense ratio (bottom right)

Besides the higher representation of women among passive funds, it’s noteworthy that women also have higher representation among low fee funds and low turnover funds – two key fund features which play a large role in the total cost of ownership of the fund, and ultimately long-term returns.

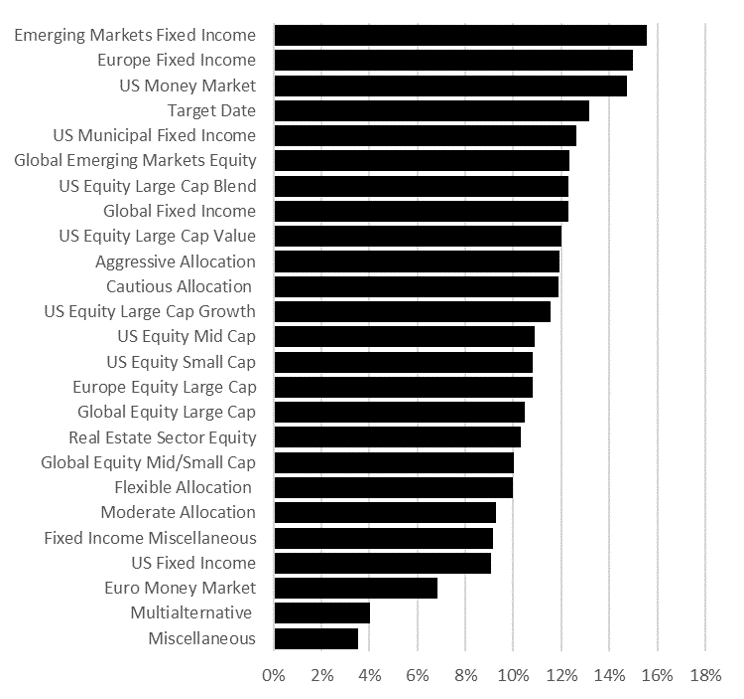

Figure 4: Percent of portfolio manager roles held by women among 25 largest global fund categories

When slicing the data by category, we find some of the highest female representation among the fastest growing categories including Emerging Markets Fixed Income and Target Date funds. Should these categories continue to outgrow others, women could end up with greater influence in asset management not though hiring practices, but via asset flows.

Investors reward funds with female managers

Whether asset managers benefit from hiring female managers is central to the question of whether an under-representation of women in portfolio manager roles is rational. Presumably, rational, unbiased asset managers would hire more female portfolio managers if it led to an economic benefit, but otherwise they would have no incentive to pursue gender diversity.

It’s clear that investors do reward funds that utilize female managers with greater organic growth rates, and that the higher percentage of female managers a fund has, the greater the organic growth. In fact, after accounting for many possible confounding factors (e.g. category, investment performance, fund family, expense ratios, etc.), male-only portfolio management teams saw virtually zero organic growth attributable to their gender, while mixed-gender teams, and female-only teams grew by roughly 1% and 2% respectively over the last five years.

Figure 5: Price premia in percentage points associated with social responsibility

Female managers have outperformed male managers over the last five years

While we don’t suggest building your retirement portfolio based on the gender of the portfolio managers, it is clear that over the last five years, women in portfolio manager roles have outperformed men on measures of absolute return, risk-adjusted return, relative risk-adjusted return, and risk. While there is mixed evidence regarding whether all-female teams or mixed-gender teams are superior, both came out ahead of the all-male teams.

Figure 6: Investment performance by portfolio management team gender composition

Our five-year study is not long enough to draw definitive conclusions about the effectiveness of gender in portfolio management, especially given that the last five years has been a prolonged bull market. Still, it is significant in showing that at least over this five-year period, women were able to earn higher returns than their peer funds at a lower level of risk. Given the difficulty of finding such anomalous factors in fund selection, investors should take note.

Conclusion

Women are under-represented in the asset management industry to the detriment of asset managers. Whether this under-representation arises from differences in choices and opportunities afforded to women, or conscious or unconscious bias within the portfolio manager hiring process is unknown.

It is clear though, that women have been accretive to asset managers in portfolio management positions through outperformance in investment performance, and in generation of excess asset flows. While the economic significance of these effects is weak (i.e. not many people are deciding to move money around based on the gender of portfolio managers alone) the statistical significance of them is robust.

Why including women on portfolio management teams boosts performance is a topic for further research, but a reasonable hypothesis would be that women are so under-represented at the moment, that their addition to portfolio management teams brings an added level of diversity of thought, leading to marginally better decision-making in portfolio construction and asset gathering. Regardless of the reason, the message to asset managers is clear – working to equalize women’s representation within portfolio management roles is in your own best interest.

References

Aggarwal, R., & Boyson, N. M. (2016). The performance of female hedge fund managers. Review of Financial Economics, 29(1), 23-36.

Atkinson, S. M., Baird, S. B., & Frye, M. B. (2003). Do female mutual fund managers manage differently?. Journal of Financial Research, 26(1), 1-18.

Barber, B. M., & Odean, T. (2001). Boys will be boys: Gender, overconfidence, and common stock investment. The quarterly journal of economics, 116(1), 261-292.

Bliss, R. T., & Potter, M. E. (2002). Mutual fund managers: does gender matter?. The Journal of Business and Economic Studies, 8(1), 1.

Employed persons by detailed industry, sex, race, and Hispanic or Latino ethnicity. (2018). Retrieved March 7, 2019, from https://www.bls.gov/cps/cpsaat18.htm.

Huang, J., & Kisgen, D. J. (2013). Gender and corporate finance: Are male executives overconfident relative to female executives?. Journal of Financial Economics, 108(3), 822-839.

Sargis, M., & Wing, K. (2018). Fund Managers by Gender - Through the Performance Lens (Rep.). Morningstar.

Contributors

Warren Miller, CFA

Founder & CEO

warren.miller@flowspring.com

©Flowspring, Inc. All Rights Reserved. The information, data, analyses and opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or accurate. The opinions expressed are as of the date written and are subject to change without notice. Except as otherwise required by law, Flowspring shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information contained herein is the proprietary property of Flowspring and may not be reproduced, in whole or in part, or used in any manner, without the prior written consent of Flowspring.